Phoenix Capital Group, a leader in mineral rights acquisitions, is proud to announce that our popular Regulation A+ investment opportunity is currently fully subscribed.

Our Regulation A+ bond offering is a 9% annual interest bond with a 3-year term that allowed the company to raise $75 million in a 12-month period for both accredited and non-accredited investors. Due to the fully-subscribed status, the 9% annual interest, 3-year term opportunity is temporarily unavailable while the company resubmits the offering with the U.S. Securities & Exchange Commission. Join our waitlist for non-accredited opportunities, and we will notify you when the offering is once again live.

“The demand demonstrates the significant interest retail investors have in the oil and gas industry. It also illustrates the trust we’ve earned with investors by delivering monthly payments through a high-yield bond product,” added Brynn Ferrari, the Chief Marketing Officer at Phoenix Capital Group.

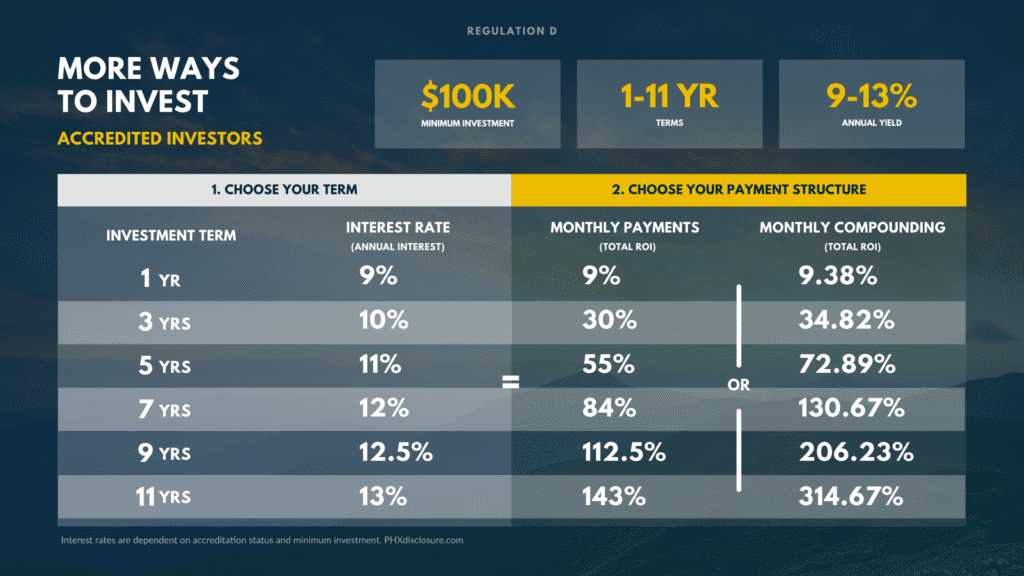

In addition to the Regulation A+, Phoenix Capital Group offers accredited investors the opportunity to earn 9-13% annual interest through a variety of investment opportunities. These securities are issued under Regulation D. Contact our Capital Markets team today if you are interested in learning more. You can reach us through email at [email protected] or by phone at (303) 376-9778.

“We are excited about this milestone, but also working as quickly as possible to take the necessary steps to re-open the investment opportunity. Equal opportunity is a huge component of our success to date. We recognize the importance of catering to both accredited and non-accredited investors,” said Curtis Allen, the Chief Financial Officer at Phoenix Capital Group.

Interested in Learning More About Our Accredited Only Bond Offerings?